Tourism is a major sector throughout the Asia-Pacific region. As people planning their next vacation search more and more for information on the Internet, their behaviors online become the key to understanding where customers will go next. This dashboard will greatly help marketers of the tourism industry in ASEAN and APAC.

The team of Think with Google Asia-Pacific has created a collection of tools to monitor Internet search trends from Google on the air transport and hotel industries, , as it did for search trends of the financial industry in APAC.

These tools report data from the search engine in the 6 big ASEAN countries, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, and several other countries of the region (Australia, Hong Kong, India, Japan, South Korea, New Zealand, Taiwan).

Reading and analyzing travel trends in ASEAN (and Asia-Pacific)

The APAC travel dashboard gathers several interactive tools to analyze travel trends throughout the ASEAN-6 countries and APAC region, often allowing to select countries and/or industry and see the evolution through time. Note that the data is updated quarterly and that it is unfortunately missing information on China, as Google is only indirectly present there.

To help you read and analyze the data in the same manner has the Think with Google did for some tourism trends in Singapore, Malaysia and Indonesia, here are some tips to use and understand the tools available with an eye on marketing for the tourism sector.

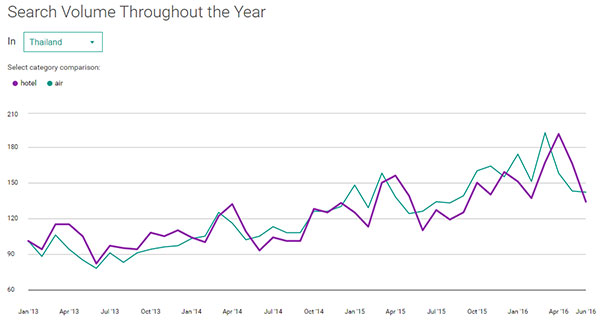

Search volume throughout the year

This first tool allows you to examine the volumes of search queries in each country for both the air travel and hotel industries. It is a great means to understand general dynamics and seasonal trends for both industries and local versus foreign travel when compared both industries.

For example, in Thailand:

- The high search volumes for air queries in February-March shows that the Thai are searching for flights to book their vacation for the Songkran holiday of mid-April.

- The high search volumes for hotel queries in April shows that after booking their transport, the Thai are looking for hotels.

- The growing volumes show a growth of 15-20% between 2015 and 2016.

Where people are traveling to?

With a ranking of search volume queries concerning travel to foreign countries, this tool provides a very convenient overview of the most demanded destinations in any given APAC country. It is critical for marketers to understand both the most sought after destinations with the general “index value” order, and the trending destinations with the year on year order.

Where people are traveling from?

The opposite from the previous one, this tool allows marketers to discern where foreign tourists are coming from to tailor their offer abroad and target their local services to specific nationalities. This tool also proposes to check for total volumes of search in the “index value” and year-on-year growing trends to anticipate the future evolution of the market.

APAC travel queries insights

The next three graphs present three sets of data that provide more insight about the APAC travel industry in general. Note that the two first graphs change depending on your initial selections of Air or Hotel view at the top of the page.

- The most popular air itinerary in APAC (Air view) shows the top 5 most sought after air travel itineraries in the whole region in the last quarter of data available.

- The most popular hotel itinerary in APAC (Hotel view) shows the top 5 most sought after hotel itineraries in the whole region in the last quarter of data available.

- The Top 10 Air Brands in Search (Air view) shows the largest amounts of branded queries for airlines, presenting the absolute and relative recognition of ten major airlines. Note the importance of AirAsia, the leading low-cost carrier in the region and one of the most famous brands from Southeast Asia.

- The Top 10 Hotel Brands in Search (Hotel view) shows the largest amounts of branded hotel queries, presenting the absolute and relative recognition of ten major hotel brands. Note the importance of Hilton Hotels.

- The Top 10 Travel-Related Questions is common for both Air and Hotel view. It shows what precise travel-related topics are most researched for. This list provides key insights on the relative importance of certain aspects of traveling, notably highlighting the importance of visa-related questions.

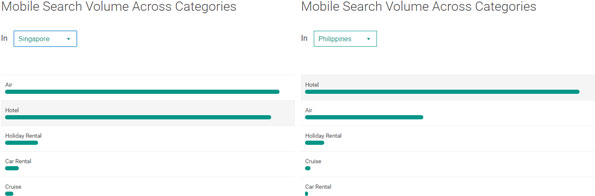

Mobile search volume across categories

This last tool provides more insights into the behaviors of mobile users in search for travel. They show the relative importance of queries on mobile devices related to Hotel, Air, Holiday rental, Car rental and Cruise. This last tool highlights how critical it is for companies operating in certain industries to have a mobile friendly approach (or not) for their digital marketing.

Singapore-Philippines example:

As highlighted by this comparison between Singapore and the Philippines, mobile queries show big disparities between countries and categories. Be careful what countries and travel categories you are planning to market your services on mobile or not!

Image captures from Think with Google’s APAC travel dashboard

![Monitoring financial trends in Asia-Pacific [tool] Asia Pacific finance search data](https://aseanup.com/wp-content/uploads/2017/05/APAC-finance-search-data-150x68.jpg)

![Strategies for the changing tourism industry in Thailand [report] Trends of the Thai tourism industry](https://aseanup.com/wp-content/uploads/2017/05/Thailand-tourism-industry-trends-150x68.jpg)