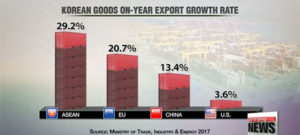

Opening a new set of opportunities for ASEAN countries, South Korea is now looking at new ways to develop economic ties in Southeast Asia. As the government scouts for new ways to diversify trade and economic ties, businesses from Southeast Asian countries could find new openings to work with South Korean companies.

Billionaires of Southeast Asia

Even though it is a developing area, Southeast Asia is already home to tens of billionaires who have built business empires across the region. Having grown their companies by working with their families or as sole entrepreneurs, ASEAN billionaires are at the head of some of the largest corporations of the region.

US business outlook in ASEAN 2018 [report]

American companies in ASEAN are benefiting from the region’s growth potential and experiencing its dynamism. With an optimistic outlook for Southeast Asia’s economic and business growth, US businesses share their sentiments, perspectives and challenges in this insightful report.

ASEAN infrastructure and building materials opportunities [video]

Good infrastructures are a key to economic activity and development. To boost their growth, ASEAN countries are planning to invest heavily in infrastructures in the coming years: not only will they provide better transport, power and sanitation but also interesting opportunities for suppliers of building materials.

4 ASEAN infographics: demography, top cities, urbanization

Cities and urbanization are some of the most important drivers of Southeast Asia’s economic dynamism, environmental, societal and cultural change. To better understand the challenge and opportunities they bring, here are 4 infographics summarizing urban trends on the demography and rural exodus in ASEAN.

International expansion tips from the Philippines [video]

Growing a company beyond its original country is a dream for many business owners and managers. Relating their experiences from expanding their businesses out of their original base in the Philippines, two business leaders share their stories, insights and tips for those interested in growing their companies abroad.

Enhancing management and leadership in ASEAN [report]

With the rapid growth of the region, companies in Southeast Asia face various challenges to manage their operations and lead their teams. The following presentation draws on the experience of many CEOs in ASEAN to assess these challenges, propose methods to tackle them successfully and prepare for the future.

Guide to doing business in Thailand 2016 [reports]

Thailand has gone through some tumultuous years that have had some impact on its economy. To help investment and growth, this complete guide to doing business in Thailand updated for 2016 will guide investors and entrepreneurs in their activities, to launch and conduct business in Thailand.

Guide to taxes in Myanmar [brackets-incentives]

With a strong appetite for development, Myanmar has adopted a very accommodating fiscal regime. A low corporate income tax, a progressive but low personal income tax, no VAT but a light “commercial tax” and strong incentives, aim at attracting and helping companies to spur the development of Myanmar’s newly opened economy.

Guide to taxes in Laos [brackets-incentives]

Taxes in Laos are among the lowest in the region: a low corporate income tax, a low progressive income tax and a low VAT make the country attractive for business. The Lao taxation system is quite simple and straightforward to encourage investment in the country and help develop its burgeoning economy.