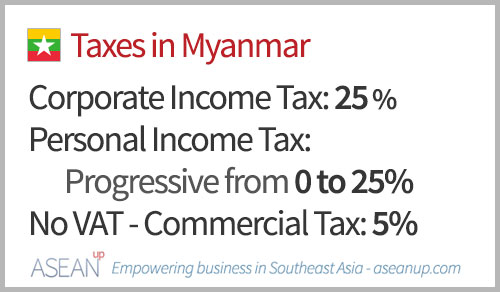

With a strong appetite for development, Myanmar has adopted a very accommodating fiscal regime. A low corporate income tax, a progressive but low personal income tax, no VAT but a light “commercial tax” and strong incentives, aim at attracting and helping companies to spur the development of Myanmar’s newly opened economy.

Main taxes in Myanmar

The main taxes levied by the Internal Revenue Department of Myanmar are the Corporate Income Tax, the Personal Income Tax and the Commercial Tax, as there is currently no Value-Added Tax.

Corporate Income Tax

Companies in Myanmar are generally taxed at a standard flat Corporate Income Tax Rate of 25%. It is applied to all income from business or professional operations, properties and other sources, such as capital gains.

Also in Business

- The Rise of Stealth Startups: How to Build in Secret and Succeed

- Top 10 Most Profitable Franchises to Own in 2025

- Business Bank Accounts vs. Personal Accounts: Why You Need Both

- Will Electric Vehicles Disrupt the Traditional Auto Industry?

- The Best Business Bank Accounts for Small Businesses in 2025

Companies are considered resident in Myanmar if they are formed under the Myanmar Resident Act, the Myanmar Foreign Investment Law – MFIL – or other Myanmar law. Branches of foreign companies are usually considered to be non-resident.

Since April 2015, the taxation rates of both resident companies and non-resident companies have been harmonized at 25%. However, resident companies are taxed upon their worldwide income, whereas non-resident companies and companies registered under the MFIL are taxed solely upon income originating from Myanmar.

A 10% tax on capital gains is also levied on both resident and non-resident companies.

Corporate tax incentives

Companies registered under the MFIL benefit from a tax exemption of five years as well as for the production of goods or services and reinvested profits. They also enjoy an accelerated depreciation, a 50% reduction of tax on export profits and other tax deductions on imported equipment and machinery.

The Special Economic Zone – SEZ – law grants special tax incentives and advantages to favor companies setting in free zones and promotion zones. These incentives include corporate tax relief for five or seven years, advantages for investors and reinvested profits, advantages for developers, exemption of import duties and taxes on certain goods.

Personal Income Tax

The Personal Income Tax rate in Myanmar is progressive from 0 to 25% depending on the amount of revenues. It is applied to all employment income such as salary (including perquisites and benefits), revenues from profession, business, property and other income.

Foreigners are considered tax residents if they reside in Myanmar at least 183 days in a calendar year. Myanmar citizens and resident foreigners, including foreigners working for MFIL companies, are taxed on their worldwide income. However, Myanmar citizens working outside of the country benefit from a tax exemption on salaries received abroad.

The Burmese personal income tax rate is progressive from 0% to 25% of yearly income as follows:

- MMK 0 – 2,000,000: 0%

- MMK 2,000,001 – 5,000,000: 5%

- MMK 5,000,001 – 10,000,000: 10%

- MMK 10,000,001 – 20,000,000: 15%

- MMK 20,000,001 – 30,000,000: 20%

- Above MMK 30,000,001: 25%

Commercial Tax

There is no Value-Added Tax in Myanmar, but a commercial tax is levied on the turnover of the sales of goods and services. It is usually applied at a standard rate of 5% on a range of goods and services produced or rendered in Myanmar, as well as on imported goods.

Further information on taxes of Myanmar

For more information on Corporate Income Tax and its exemptions, Personal Income Tax, the Commercial Tax and other specific taxes applied on particular goods and revenue sources together with information on registration and payments, check Myanmar tax leaflet 2016 created by Deloitte and the website of the Inland Revenue Department of Myanmar.

Check the Guide to doing business in Myanmar for additional detailed information on the taxes in Myanmar in the document published by PwC, and further details and tips on doing business in the country.

![Guide to taxes in the Philippines [brackets-incentives] Taxes in the Philippines](https://aseanup.com/wp-content/uploads/2016/06/Philippines-taxes-150x68.jpg)

![Guide to taxes in Cambodia [brackets-incentives] Taxes in Cambodia](https://aseanup.com/wp-content/uploads/2016/03/Cambodia-taxes-150x68.jpg)

![Guide to taxes in Laos [brackets-incentives] Taxes in Lao PDR](https://aseanup.com/wp-content/uploads/2016/07/Laos-taxes-150x68.jpg)

![Guide to taxes in Vietnam [brackets-incentives] Taxes in Vietnam](https://aseanup.com/wp-content/uploads/2016/05/Vietnam-taxes-150x68.jpg)