With the world’s third-largest population and a comparatively low, but growing, Internet connectivity, Southeast Asia is an upcoming market of interest for e-commerce. Still in its infancy, the ASEAN e-commerce market presents many growth opportunities for businesses ready to face its challenges.

The e-commerce market in ASEAN

Southeast Asia is currently a very attractive market for companies involved globally in the e-commerce sector and smaller local players. At a turning point in terms of Internet and mobile penetration, the population of Southeast Asia is quickly adapting its behaviors to take advantage of new opportunities available in purchasing products and services online.

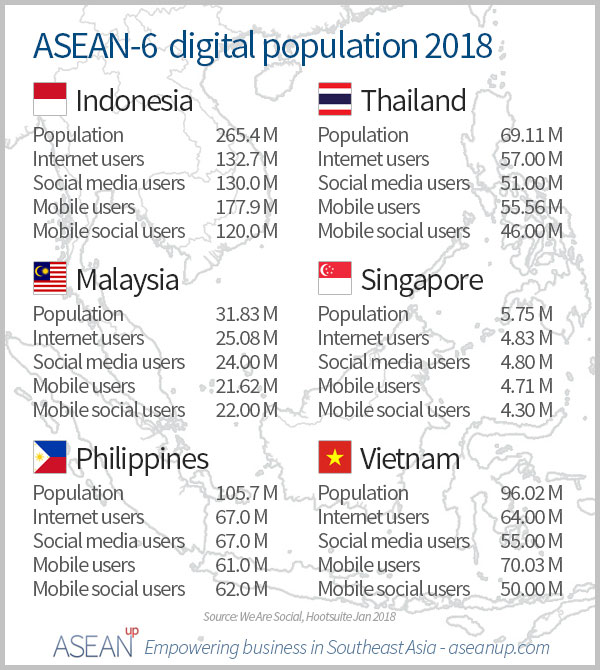

The number of Internet users in Southeast Asia, and particularly in the 6 largest ASEAN countries, add up to create a largely untapped market. Though the Singaporean e-commerce market is more mature and the Malaysian market is more dynamic, in Indonesia, Thailand, the Philippines, and Vietnam, e-commerce is still at a very early stage and remains an important reservoir of growth for ASEAN.

In these countries, the rapid development of technological infrastructures and growing levels of income ensure that the market’s expansion provides room for growth of existing players or newcomers, be they local or foreign companies.

For more information on each market’s potential, the state of the competition between online players and a detailed presentation of the leaders of e-commerce in each country, check the following resources:

- Top 10 e-commerce sites in Malaysia

- Top 10 e-commerce sites in Indonesia

- Top 10 e-commerce sites in Thailand

- Top 10 e-commerce sites in Singapore

- Top 10 e-commerce sites in the Philippines

You can also find information about the leaders of e-commerce in other countries on Disfold, notably in the US, UK, Canada, Australia, and India.

Trends for e-commerce in Southeast Asia

The following slide deck provides a general overview of the most interesting trends in e-commerce in Southeast Asia: a large, addressable and maturing market that is particularly well versed in the use of mobile devices and social media.

With details on the latest developments of start-ups, companies, and investors until 2015, this presentation lists the key players of the region and how the business is evolving in the US and other more mature markets.

Key trends and major players of e-commerce in Southeast Asia

- Southeast Asia’s population – slide 10

- A young population, 67% under 35 years old – slide 12

- …and becoming richer – slide 13

- Structural shift in the use of Internet in Southeast Asia – slide 14

- Comparing Southeast Asia’s online landscape – slide 15

- More time spent on Internet in Southeast Asia than in East Asia – slide 16

- Internet has surpassed TV – slide 17

- 50%+ use mobile while watching TV – slide 18

- A high mobile penetration rate – slide 19

- Room for growth – slide 20

- More affordable smartphones – slide 21

- Mobile operating systems market share – slide 22

- Social media drives internet penetration in Southeast Asia – slide 23

- LINE, some interesting stats – slide 24

- Facebook, some interesting stats from Thailand – slide 25

- Mobile-first behavior – slide 26

- Southeast Asia has a very low e-commerce penetration – slide 27

- …relative to population and GDP – slide 28

- ASEAN’s market potential is massive – slide 29

- ASEAN at an inflection for e-commerce – slide 30

- In only 5 years – slide 31

- Digital development in a global perspective – slide 32

- Major activities of listed players in Southeast Asia – slide 33

- Thailand – listed players are paving the way – slide 34

- Challenges for offline retailers – slide 35

- Governments’ initiative to support – slide 36

- Southeast Asia tech funding at an inflection point – slide 37

- Closer look into the unicorns – slide 38

- Most funds flow in Southeast Asia to e-commerce and marketplace – slide 39

- Southeast Asia’s recent sizable e-commerce deals – slide 40

- Southeast Asia’s companies recently raised over $ 100 M – slide 41

- Several notable exits in Southeast Asia – slide 42

- What’s coming next for e-commerce in Southeast Asia until 2020 – slide 43

- Summary – slide 44

- Theme’s shaping e-commerce in Southeast Asia until 2020 – slide 46

- Asian messaging apps monetization – slide 47

- 2015 largest deal goes into mobile commerce – slide 48

- Social and mobile commerce in Southeast Asia – slide 49

- Trends happening in the US – slide 50

- Rising on-demand in Southeast Asia – slide 51

- Public internet companies capitalization 1995-2015 – slide 52

Facts and figures of e-commerce in ASEAN-6

This second slideshow provides a lot of detailed information, facts and figures on e-commerce in Southeast Asia in general, as well as its major markets: Singapore, Thailand, Malaysia, Indonesia, the Philippines, and Vietnam.

For a more comfortable reading, it is quite suggested to open the report in full screen!

Key facts and figures of e-commerce in Southeast Asia

Key factors of development – slide 5

- Rise of Middle Class

- Greater mobile/Internet penetration

- More supply of new e-Commerce players

- Increasing logistic options

- Alternative Payment Methods

Key challenges – slide 6

- Lack of a robust ecosystem

- Management of customer expectations and perception

- High customer service needs for small purchases

- Trust in online payments

- Securing the supply chain

- Cross border commerce issues

- Inconsistent duties

- Logistics, taxes, customs clearance, payment methods

- Corruption

- Lack of reliable, low-cost logistics infrastructure

- Local contracts, deals, localization for each ASEAN country

- Fulfillment infrastructure not built to serve the scale of e-commerce scale

- Foreign Ownership Regulations

See below for more details on the challenges of e-commerce in Southeast Asia.

Tables, figures, and comparisons

- ASEAN e-commerce landscape – slide 7

- ASEAN shopping websites traffic comparison – slide 8

- Rise of the middle class – slide 9

- Greater Internet penetration: ASEAN 2011-2016 – slide 10

- Increasing supply of e-commerce & logistics players – slide 11

- E-commerce market size (2013) and potential – slide 12

- E-commerce value chain – slide 13

- Platform architecture – slide 14

- Framework for competitive analysis – slide 15

- Foreign ownership regulation for e-commerce – slide 16

- Status of e-commerce law in ASEAN – slide 17

- Impacts of customs in ASEAN – slide 18

- Status of transport network in ASEAN – slide 19

- Country differences – slide 20

- Country similarities – slide 21

Appendix

- E-commerce market size – ASEAN 7 Billion USD in 2013 – slide 23

- A huge growth opportunity – slide 24

- E-commerce potential in ASEAN – slide 25

Indonesia

- Indonesia middle class – slide 27

- Indonesia online shoppers – slide 28

- Preferred e-commerce channels in Indonesia – slide 29

- Preferred e-commerce payment methods (2013) – slide 30

- Innovative Indonesian payment methods (2013) – slide 31

- Indonesia Top Shopping websites by monthly traffic (March 2014) – slide 32

- Popular categories (2013) – slide 33

- Timeline – slide 34

Philippines

- Philippines middle class – slide 36

- Philippines Top Shopping websites by monthly traffic (March 2014) – slide 37

- Timeline – slide 38

Thailand

- Thailand Top Shopping websites by monthly traffic (March 2014) – slide 40

- Timeline – slide 41

- Example of US import tax calculation in Thailand – slide 42

Malaysia

- Malaysia Top Shopping websites by monthly traffic (March 2014) – slide 44

- Timeline – slide 45

- Challenges in SME adoption – slide 46

Vietnam

- Timeline – slide 48

Financials

- E-commerce valuations – slide 50

- Zalora financials H1 2014 – slide 51

- Lazada financials H1 2014 – slide 52

- Listed logistics companies – slide 53

Challenges of e-commerce in ASEAN

ATKearney has recently published a report to help understand the challenges faced by e-commerce companies in Southeast Asia and how to pass these obstacles. It is summarized in 5 key guidelines to help companies and authorities develop the e-commerce business in Southeast Asia.

- Increase broadband access

- Support the emergence of local players

- Reinforce online security

- Promote e-payment

- Improve logistics and trade efficiency

Answering to Bloomberg TV Malaysia’s Sophie Kamaruddin, Olivier Gergele, Principal at ATKerney, explains how the offering of online shops is critical for success in the region while presenting the findings of the report. In this video, he also highlights the report’s main points and how the market could grow by 25% a year.

The case of Zalora: a leader in fashion e-commerce in Southeast Asia

Zalora Group, a pioneering company in Southeast Asia’s online fashion retail, has been moving fast to grab a big portion of the fashion e-commerce market in ASEAN. Launched in late 2011 by the German startup incubator Rocket Internet, Zalora is based in Singapore and regroups more than 2000 staff across Southeast Asia and beyond.

Michele Ferrario, Zalora’s managing director, shares some insights and perspectives on growing an online fashion retailer across the region.

A promising market

People in secondary cities of countries like Indonesia, the Philippines, Vietnam or Thailand do not have the same access to fashion as in the larger and more connected cities like Singapore.

Rocket Internet, therefore, seized the opportunity to develop Zalora and strengthen its position in e-commerce in Southeast Asia which is expected to skyrocket in the coming years.

Some challenges

However, Zalora faces fierce competition from global heavyweights like Amazon, ASOS, Alibaba, and Rakuten. It also needs to address local infrastructure challenges for effective cash collection and merchandise delivery in each country.

Zalora has therefore developed its own infrastructure to satisfy its customers’ needs. They have created warehouses in each country and partnered with local delivery companies in every country to ensure fast delivery. Zalora focuses on delivering great customer experience, while also learning about the local markets and habits and sharing global best practices.

The first-mover strategy

To reach its present size, Zalora has moved very fast: they opened in six markets in the first six months, with warehouses in each country, and hired 1000 staff. The critical elements to conquering the Southeast Asian market have been scale, speed and customer satisfaction. To ensure customer satisfaction, Zalora has hired a dedicated team to implement best practices and learn from negative feedback.

A fashion startup culture

Zalora’s core team was built in the first year of existence and it has stood together since then. They have hired new talents as the company developed later on, but the company does not face a big staff turnover problem, as Zalora employees share a common company culture.

Employees share the vision that they are involved in the same team with a similar lifestyle and work experience. It also helps that the average age of employees is below 30 years old, with many of these young people holding important responsibilities.

A “glocal” supply chain

In order to cope with different fashion tastes across the region, Zalora customizes certain areas of its business while other parts are standardized. This creates important needs for sourcing and logistics management in a mixed supply chain: some products are sourced in each country from local manufacturers while global brands are managed by the Singapore team and dispatched across the region.

Key figures of the online fashion market in Southeast Asia and Zalora’s appetite

- The fashion market in Southeast Asia is expected to reach 100 Billion USD by 2018

- About 20% of fashion retailing is now done online in the US and Europe, while a fraction of this is currently happening in Southeast Asia

- Zalora hopes to capture close to 50% of the online fashion market of Southeast Asia

ASEAN e-commerce growth perspectives

In some countries, consumers still face difficulties to reach traditional shops. Potential customers are therefore even more eager to buy online the goods they cannot obtain locally. These retailing challenges are however transferred to the sellers who need to find new solutions to collect payments and deliver products.

Despite these difficulties, big and small companies are rushing to move and sell online, as many analysts expect the market to boom in the coming years. With less than 1% of the total retail market currently happening online (except in Singapore), if it were to reach 5% of total retail, the Southeast Asian e-commerce market could be worth more than 20 Billion USD.

Presentations respectively from November 2015 by Dr. Adrian Vanzyl and from March 2015 by Nittin Mittal. Youtube videos from September 2015 by Blomberg TV Malaysia and January 2015 by CNBC International

![Insights and trends of e-commerce in the Philippines [market analysis] e-commerce market Philippines](https://aseanup.com/wp-content/uploads/2018/09/Philippines-e-commerce-market-150x68.jpg)

![Insights and trends of e-commerce in Indonesia [market analysis] E-commerce in Indonesia](https://aseanup.com/wp-content/uploads/2017/07/Indonesia-e-commerce-150x68.jpg)

Hey guys, great news! The new Lazada extention is ready for use! Now you can check the price history on all sellers whith the “Lazada Price Tracker”. You can see how the price changed before and if it’s up you can wait until it will go down or you can ask the seller for a discount! The extention is available just for browser chrome for now! https://chrome.google.com/webstore/detail/lazada-price-tracker/hbffioiakemflkglioiijpfddgahchaf?gl=SG

Hi Jappon,

Thanks for sharing, this could be useful.