The 30 largest corporations of the Philippines weigh very heavily in the country’s economy, and further, in Southeast Asia and the world. Together forming the PSEi index, the main stock index of the country, they have been regrouped in this handy list that presents each company and its activities, together with useful links.

List of the 30 components of the PSEi index

In the Philippines, large companies often become corporations to get listed on the stock exchange, comply with the regulatory agencies and gain access to capital from stock markets.

In the Philippines, large companies often become corporations to get listed on the stock exchange, comply with the regulatory agencies and gain access to capital from stock markets.

In the Philippines, such corporations are quoted in the Philippine Stock Exchange – PSE, which is in charge of ensuring proper market conditions for the trading of the country’s stocks. The PSE is a member of the ASEAN Exchanges.

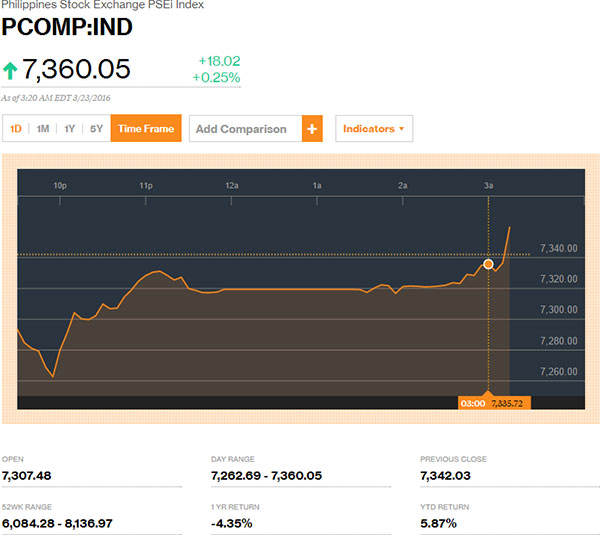

To develop trading and ease the evaluation of the Philippine market, the stock prices of the thirty largest corporations of the Philippines are compiled together to form the PSE Composite Index – abbreviated PSEi –, a capitalization-weighted index that is widely accepted as a reference index of the Philippines, among other indexes.

For the latest rankings on companies abroad, including US companies, UK companies, Canadian companies, and Australian companies on the Disfold data platform.

The PSEi index

The real-time quotation of the PSE Composite Index – PSEi – can be followed from the Philippine Stock Exchange’s website and through the convenient graphical tools from Bloomberg or the ASEAN Exchanges. For more information on the PSEi index and the up-to-date weights of each stock, check the information from the PSE website.

Details of the top 30 largest listed companies of the Philippines

To help you learn more about these economic heavyweights, the list of the thirty companies that compose the PSEi index – the thirty largest publicly listed corporations of the Philippines –, has been regrouped hereafter with presentations of each company’s activities, direct links to its websites and stock prices live details from the PSE website.

Even though some of these companies are subsidiaries from the same group, several of these Philippine corporations, including some of these subsidiaries, are also part of the largest companies in Southeast Asia.

For more information about the other top public listed companies of Southeast Asia, check the lists of companies in other major ASEAN countries:

Quick links to the top 30 public listed companies in the Philippines’ PSEi

To facilitate browsing in this list, here are links to go directly to the details of any of the PSEi companies.

- Aboitiz Equity Ventures, Inc. – sector: Holding Firms

- Aboitiz Power Corp. – sector: Energy & Utilities

- Alliance Global Group, Inc. – sector: Holding Firms

- Ayala Corporation – sector: Holding Firms

- Ayala Land, Inc. – sector: Real Estate

- Bank of The Philippine Islands – sector: Finance

- BDO Unibank, Inc. – sector: Finance

- DMCI Holdings, Inc. – sector: Holding Firms

- First Gen Corporation – sector: Energy & Utilities

- Globe Telecom, Inc. – sector: Telecommunications

- GT Capital Holdings, Inc. – sector: Holding Firms

- International Container Terminal Services, Inc. – sector: Transportation & Logistics

- JG Summit Holdings, Inc. – sector: Holding Firms

- Jollibee Foods Corporation – sector: Food & Beverages

- LT Group, Inc. – sector: Holding Firms

- Manila Electric Company – sector: Energy & Utilities

- Megaworld Corporation – sector: Real Estate

- Metro Pacific Investments Corporation – sector: Holding Firms

- Metropolitan Bank & Trust Company – sector: Finance

- Petron Corporation – sector: Energy & Utilities

- Philippine Long Distance Telephone Company – sector: Telecommunications

- Puregold Price Club, Inc. – sector: Commerce

- Robinsons Land Corporation – sector: Real Estate

- Robinsons Retail Holdings, Inc. – sector: Commerce

- San Miguel Corporation – sector: Food & Beverages

- Security Bank Corporation – sector: Finance

- SM Investments Corporation – sector: Holding Firms

- SM Prime Holdings, Inc. – sector: Real Estate

- Semirara Mining And Power Corporation – sector: Mining / Energy & Utilities

- Universal Robina Corporation – sector: Food & Beverages

For the second semester of 2017, the full detailed list of the constituents of the PSEI is as follows.

Aboitiz Equity Ventures

Sector: Holding Firms

Sector: Holding Firms

Aboitiz Equity Ventures, Inc. is the publicly listed holding and investment company of the Aboitiz Group, notably involved in power, banking and financial services, food, land, and infrastructure.

Website: aboitiz.com – stock symbol: AEV

Aboitiz Power

Sector: Energy & Utilities

Sector: Energy & Utilities

A leader in the Philippines’ power sector, AboitizPower Corporation is Aboitiz Group’s holding company for investments in power generation, distribution and retail electricity services.

Website: aboitizpower.com – stock symbol: AP

Alliance Global Group

Sector: Holding Firms

Sector: Holding Firms

Alliance Global Group, Inc. is a conglomerate involved in the food and beverage industry, real estate development and quick service restaurants, franchisee of McDonald’s in the Philippines.

Website: allianceglobalinc.com – stock symbol: AGI

Ayala

Sector: Holding Firms

Sector: Holding Firms

Ayala Corporation is the Philippines’ oldest and largest conglomerate, with interests in retail, education, real estate, banking, telecommunications, water infrastructure, renewable energy, electronics, information technology, automotive, healthcare and business process outsourcing.

Website: ayala.com.ph – stock symbol: AC

Ayala Land

Sector: Real Estate

Sector: Real Estate

A subsidiary of Ayala Corporation, Ayala Land, Inc. is the largest property developer in the Philippines, with core businesses in strategic landbank management, residential development, shopping centers, corporate businesses, and hotels.

Website: ayalaland.com.ph – stock symbol: ALI

Bank of The Philippine Islands

Sector: Finance

Sector: Finance

The Bank of The Philippine Islands is the oldest and one of the largest banks in the Philippines, currently owned by Ayala Corporation. It is involved in consumer banking and lending, asset management, insurance, securities brokerage and distribution, foreign exchange, leasing, and corporate and investment banking.

Website: bpiexpressonline.com – stock symbol: BPI

BDO Unibank

Sector: Finance

Sector: Finance

BDO Unibank, also known as BDO and Banco De Oro, is the largest bank in the Philippines belonging to the SM Group of Companies. It is a universal bank with subsidiaries operating in leasing and financing, investment banking, private banking, insurance, and stock brokerage.

Website: bdo.com.ph – stock symbol: BDO

DMCI Holdings

Sector: Holding Firms

Sector: Holding Firms

DMCI Holdings is a company primarily engaged in the construction business and construction components. Through its various subsidiaries, it is involved in construction services, property development, mining, power plant construction and operation, and water distribution.

Website: dmciholdings.com – stock symbol: DMC

First Gen

Sector: Energy & Utilities

Sector: Energy & Utilities

First Gen Corporation is a leading power production and energy services company, subsidiary of First Philippine Holdings Corporation. It operates several power plants throughout the country based upon several sources of energy: geothermal, solar, natural gas, hydroelectricity, and wind power.

Website: firstgen.com.ph – stock symbol: FGEN

Globe Telecom

Sector: Telecommunications

Sector: Telecommunications

Globe Telecom, also known as Globe, is a major telecommunications services company operating one of the largest mobile, fixed-line, and broadband networks in the Philippines.

Website: globe.com.ph – stock symbol: GLO

GT Capital Holdings

Sector: Holding Firms

Sector: Holding Firms

GT Capital Holdings is a conglomerate involved in banking, property development, power generation, automotive assembly, importation, wholesaling, dealership, and financing, and life and non-life insurance.

Website: gtcapital.com.ph – stock symbol: GTCAP

International Container Terminal Services

Sector: Transportation & Logistics

Sector: Transportation & Logistics

International Container Terminal Services, Inc. – ICSTI – is a port management company. Historically operating the Manila International Container Terminal, ICTSI is now in the businesses of acquiring, developing, managing and operating container ports and terminals worldwide.

Website: ictsi.com – stock symbol: ICT

JG Summit Holdings

Sector: Holding Firms

Sector: Holding Firms

JG Summit Holdings, Inc. is a leading conglomerate involved in a variety of industries: food and beverages, real estate and hotels, air transportation, banking, petrochemicals, telecommunications and in power distribution.

Website: jgsummit.com.ph – stock symbol: JGS

Jollibee Foods

Sector: Food & Beverages

Sector: Food & Beverages

Jollibee is the largest fast-food chain in the Philippines, operating more than 750 stores, and engaged in international expansion in the USA, Vietnam, Hong Kong, Saudi Arabia, Qatar, and Brunei.

Website: jollibee.com.ph – stock symbol: JFC

LT Group

Sector: Holding Firms

Sector: Holding Firms

LT Group is a conglomerate majority-owned by Tangent Holdings Corporation, which operates across consumer-focused businesses of beverages and distilled spirits, tobacco, property development, and banking.

Website: ltg.com.ph – stock symbol: LTG

Manila Electric Company

Sector: Energy & Utilities

Sector: Energy & Utilities

The Manila Electric Company, also known as Meralco, is the largest distributor of electrical power in the Philippines.

Website: meralco.com.ph – stock symbol: MER

Megaworld

Sector: Real Estate

Sector: Real Estate

Megaworld Corporation is a leading real estate developer in the Philippines. It is primarily involved in the development of large-scale, mixed-use, planned communities and in the development and administration of offices for business-process outsourcing.

Website: megaworldcorp.com – stock symbol: MEG

Metro Pacific Investments

Sector: Holding Firms

Sector: Holding Firms

Metro Pacific Investments Corporation is a leading infrastructure holding company operating in water utilities, toll roads, electricity distribution, hospitals, and light rail.

Website: mpic.com.ph – stock symbol: MPI

Metropolitan Bank & Trust Company

Sector: Finance

Sector: Finance

The Metropolitan Bank and Trust Company, also known as Metrobank, is the second-largest bank in the Philippines with a diverse offering of financial services, from consumer and business banking to insurance.

Website: metrobank.com.ph – stock symbol: MBT

Petron

Sector: Energy & Utilities

Sector: Energy & Utilities

Petron Corporation is the largest oil refining and marketing company in the Philippines, supplying about 40% of the country’s oil requirements. It is majority-owned by the San Miguel Corporation.

Website: petron.com – stock symbol: PCOR

Philippine Long Distance Telephone Company

Sector: Telecommunications

Sector: Telecommunications

The Philippine Long Distance Telephone Company, commonly known as PLDT, is the largest telecommunications and digital services company in the Philippines, with businesses in fixed-line and wireless networks.

Website: pldt.com – stock symbol: TEL

Puregold Price Club

Sector: Commerce

Sector: Commerce

Puregold Price Club, better known as Puregold is a chain of supermarkets engaged in the retail and wholesale of consumer goods in the Philippines.

Website: puregold.com.ph – stock symbol: PGOLD

Robinsons Land

Sector: Real Estate

Sector: Real Estate

Robinsons Land Corporation is a leading real estate company involved in the development and operation of shopping malls and hotels, mixed-use properties, office buildings, residential condominiums, and housing.

Website: robinsonsland.com – stock symbol: RLC

Robinsons Retail Holdings

Sector: Commerce

Sector: Commerce

Robinsons Retail Holdings is a retail company operating several brands in the Philippines including Handyman Do it Best, True Value, Topshop, Topman, Toys “R” Us, Ministop, Daiso Japan, Costa Coffee.

Website: robinsonsretailholdings.com.ph – stock symbol: RRHI

San Miguel

Sector: Food & Beverages

Sector: Food & Beverages

San Miguel Corporation is Southeast Asia’s largest publicly listed food, beverage and packaging company as well as the Philippines’ largest corporation in terms of revenue. It is a diversified conglomerate with operations in beverages (notably the flagship San Miguel beer), food, packaging, fuel and oil, power, mining, and infrastructure.

Website: sanmiguel.com.ph – stock symbol: SMC

Security Bank

Sector: Finance

Sector: Finance

Security Bank is a universal bank in the Philippines operating in Corporate and Investment Banking, Commercial Middle Market Banking, Retail Banking, and Financial Markets, with a solid niche among the mass affluent Filipino-Chinese community.

Website: securitybank.com – stock symbol: SECB

SM Investments

Sector: Holding Firms

Sector: Holding Firms

SM Investments Corporation, SM Investments, or SMIC, is a holding company involved in shopping mall development and management, retail, real estate development, banking, and tourism.

Website: sminvestments.com – stock symbol: SM

SM Prime Holdings

Sector: Real Estate

Sector: Real Estate

SM Prime Holdings, or SM Prime, is the SM Group’s company in charge of developing, operating and maintaining shopping malls and their related businesses in retail. Its revenues originate from rental income, as well as entertainment businesses such as cinema ticket sales, bowling and ice-skating.

Website: smprime.com – stock symbol: SMPH

Semirara Mining and Power Corporation

Sector: Mining / Energy & Utilities

Sector: Mining / Energy & Utilities

Semirara Mining and Power Corporation is the largest coal producer in the Philippines, which is also involved in power production. By integrating its mining and power activities, the company can better manage fuel supply and power production.

Website: semiraramining.com – stock symbol: SCC

Universal Robina

Sector: Food & Beverages

Sector: Food & Beverages

Universal Robina Corporation is one of the largest food and beverage companies in the Philippines, with an important and growing presence in other ASEAN markets. It is involved in the manufacture and distribution of branded consumer foods, commodities, and agro-industrial businesses.

Website: urc.com.ph – stock symbol: URC

Here is a summary of the list of the 30 Philippine companies in the PSEi index with their name, logo, sector, and stock symbol.

Here are the thirty largest publicly listed companies in the Philippines. Did you know them all? Do you have any idea how they should keep on growing their activities in the Philippines, Southeast Asia and the rest of the world?