Southeast Asia is a powerhouse for the automotive industry in Asia and beyond with very attractive perspective for the coming years. The region presents the double interest of having large markets with important sales growth potential and important automotive manufacturing hubs to produce for Asia and the world.

With the global economy cooling, while China, Brazil and Russia have seen less dynamic car sales recently Southeast Asia has been resilient. Its large market of more than 600 million people and its combined GDP of about 2 Trillion USD with an annual growth over 5% lets car manufacturers remain optimistic about the Southeast Asian market for the coming years.

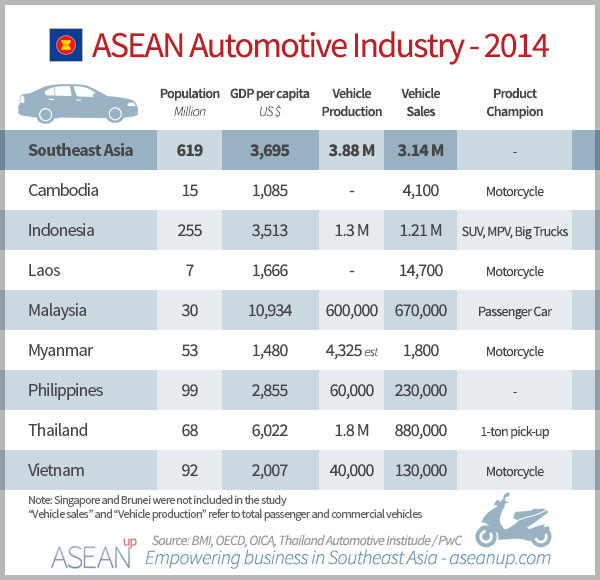

Key data on the ASEAN automotive industry

This first video illustrates the importance of ASEAN both as a market and a production hub for the global automotive industry. Each of the 6 major ASEAN countries present specific advantages, but the importance of the automotive industry of Thailand is also highlighted, as Thailand remains the major production hub in the region.

In this context, PwC has prepared a useful report on the automotive industry and its opportunities and challenges in the region. It will help car manufacturers define the proper strategy to tackle the market and all those interested in the automotive industry to better understand the situation and trends in each ASEAN country.

Among other interesting data and analysis gathered in the report, the strong potential for growth in car sales in certain ASEAN countries is highlighted by the low percentage share of households that own a car.

If the mature Malaysian market shows 82% of households owning a car in 2014, this share is 51% in the developing market Thailand, while some ASEAN markets seem to be almost untapped: Philippines (8%), Indonesia (4%) and Vietnam (2%), which are all three very populated countries.

While these countries present great opportunities for local sales, the report also notably highlights the critical production advantage of certain countries. Thailand and Indonesia, especially, are very convenient manufacturing hubs to produce vehicles for export in the region, Asia and beyond.

This dual aspect of certain Southeast Asian countries creates both potential for economies of scale and logistics difficulties for automotive industry companies. Such characteristics coupled with various levels of maturity in the different automotive markets make a challenging environment to succeed at the regional level.

To implement the right strategy for Southeast Asia other elements need to be taken into account: consumers’ habits, national preferences, rising disposable income, skilled labor shortages, online marketing potential… Properly including these parameters will be the key to take over the ASEAN automotive market.

Southeast Asian automotive industry and strategies – report summary

- Southeast Asia’s motoring potential – page 2

- An uneven road to growth – page 3

- Dual carriageway – Regional manufacturing hub and local sales – page 4

- Bumps in the road – Volatility and complexity – page 7

- Navigating Growth Markets – page 8

- Strategies to steer through complexity – page 9

- Cambodia, Laos, Myanmar, Vietnam (CLMV) – The next automotive frontiers – page 15

Evolution and comparisons of the ASEAN automotive industry

Going further to compare the ASEAN automotive industry to other major economic regions of the world, the following presentations dives into more data to put the region’s into perspectives with Europe, America, China and the rest of Asia.

Highlighting the key driving forces of the automotive sector in Southeast Asia, this slideshow also provides some estimations of the industry’s evolution to 2020, as well as an overview of the global trends that affect the industry.

ASEAN automotive roadmap 2020 – summary

Global car production 2005-2014 – slide 2

ASEAN automotive statistics – slide 3

- Total Car production and sales 2014 – slide 3

- Car density 2015 – slide 4

- ASEAN car density forecast 2013-2021 – slide 5

- ASEAN population and market – slide 6

- Production forecast – slide 7

- Market share by brand – slide 8

ASEAN roadmap 2020 – slide 9

- Key drivers: Gasoline – slide 9

- Key drivers: Electric mobility – slide 10

- Key drivers: Social media – slide 11

- Key drivers: Autonomous mobility – slide 12

- Key drivers: Logistics & performance – slide 13

- Key drivers: Tax & duty regime – slide 15

- Key drivers: Education – slide 17

- Key drivers: Grey market – slide 18

- Key drivers: Automation and integration – slide 19

- Key drivers: Infrastructure – slide 20

- Key drivers: Safety – slide 21

- Key drivers: Government policy – slide 22

- Key drivers: Volkswagen group – slide 23

- Key drivers: Communication – slide 24

Video from February 2016 by Ipsos Business Consulting and slidedeck from August 2015 by Uli Kaiser

![Southeast Asia digital economy 2025 [report] Southeast Asia digital economy 2025](https://aseanup.com/wp-content/uploads/2016/06/Southeast-Asia-digital-economy-2025-150x68.jpg)