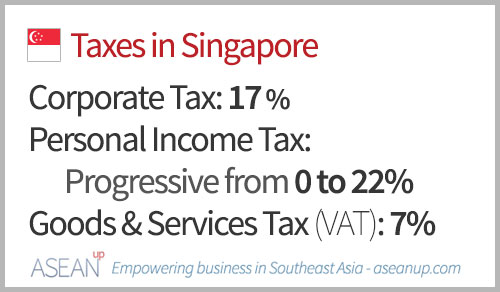

Taxes in Singapore are part of what makes it one of the best places to do business. With a simple and clear system of low corporate tax, personal income and goods and services tax (VAT), Singapore is attractive for most businesses. Several schemes further alleviate taxes for companies, fostering the pro-business environment even further.

Main taxes in Singapore

The main taxes levied by the Inland Revenue Authority of Singapore – IRAS – are the Corporate Tax, the Personal Income Tax and the Goods and Services Tax (similar to VAT).

Corporate Tax

Since 2010, the official Corporate Tax in Singapore is 17%. It is applied on all chargeable income of all companies, be they local or foreign companies.

Corporate Tax Exemption

Small companies and startups can benefit from a corporate tax exemption for their first 3 years of activity. All companies except those involved in investment holding and properties development for sales and investment can apply to benefit from the following tax exemption scheme designed to support startups and entrepreneurship.

| Chargeable Income |

% Exempted from Tax |

Amount Exempted from Tax |

| First SGD 100,000 |

100% |

SGD 100,000 |

| Next SGD 200,000 |

50% |

SGD 100,000 |

The maximum exemption to be enjoyed is SGD 200,000 (SGD 100,000 + SGD 100,000).

Other companies can still benefit from the following Partial Tax Exemption scheme.

| Chargeable Income |

% Exempted from Tax |

Amount Exempted from Tax |

| First SGD 10,000 |

@75% |

= SGD 7,500 |

| Next SGD 290,000 |

@50% |

= SGD 145,000 |

The maximum exemption to be enjoyed is SGD 152,500 (SGD 7,500 + SGD 145,000).

Corporate Tax Rebate

In order to help companies cope with rising costs in the island nation, the Singaporean authorities also have allowed for a tax rebate for all companies. This rebate of 30% is capped at an amount of 30,000 SGD of taxes payable for years 2013 to 2015 and 20,000 SGD for years 2016 and 2017.

| Year of Assessment |

Corporate Income Tax Rebate |

Capped at |

| 2016 and 2017 |

30% |

SGD 20,000 |

| 2013 to 2015 |

30% |

SGD 30,000 |

For more information on Corporate Tax in Singapore, exemptions and rebates, check the IRAS page on Corporate Tax.

Personal Income Tax

Individuals are submitted to Personal Income Tax depending on their residency status. A person will be treated as a resident in Singapore in the following situations:

- Singapore citizen who resides in Singapore except for temporary absences,

- Singapore permanent resident who has established a permanent home in Singapore

- Foreigner who has stayed / worked in Singapore (excludes director of a company) for 183 days or more in the year before the year of assessment

Any other person who does not fall in either one of these situations will be treated as a non-resident of Singapore for tax purposes.

Resident Tax Rates

For the year of assessment 2012 to 2016

| Chargeable Income |

Income Tax Rate (%) |

Gross Tax Payable (SGD) |

First SGD 20,000

Next SGD 10,000 |

0

2 |

0

200 |

First SGD 30,000

Next SGD 10,000 |

–

3.50 |

200

350 |

First SGD 40,000

Next SGD 40,000 |

–

7 |

550

2,800 |

First SGD 80,000

Next SGD 40,000 |

–

11.5 |

3,350

4,600 |

First SGD 120,000

Next SGD 40,000 |

–

15 |

7,950

6,000 |

First SGD 160,000

Next SGD 40,000 |

–

17 |

13,950

6,800 |

First SGD 200,000

Next SGD 120,000 |

–

18 |

20,750

21,600 |

First SGD 320,000

Above SGD 320,000 |

–

20 |

42,350 |

For the year of assessment 2017

| Chargeable Income |

Income Tax Rate (%) |

Gross Tax Payable (SGD) |

On the first 20,000

On the next 10,000 |

0

2 |

0

200 |

On the first 30,000

On the next 10,000 |

–

3.50 |

200

350 |

On the first 40,000

On the next 40,000 |

–

7 |

550

2,800 |

On the first 80,000

On the next 40,000 |

–

11.5 |

3,350

4,600 |

On the first 120,000

On the next 40,000 |

–

15 |

7,950

6,000 |

On the first 160,000

On the next 40,000 |

–

18 |

13,950

7,200 |

On the first 200,000

On the next 40,000 |

–

19 |

21,150

7,600 |

On the first 240,000

On the next 40,000 |

–

19.5 |

28,750

7,800 |

On the first 280,000

On the next 40,000 |

–

20 |

36,550

8,000 |

On the first 320,000

In excess of 320,000 |

–

22 |

44,550 |

Non-Residents Tax Rates

Employment Income

A flat rate of 15% will be applied to the employment income of non-residents or the progressive resident tax rates (presented previously), whichever is higher.

Director’s fee, Consultation fees and Other Income

A flat rate of 20% is generally applied to director’s fees, consultation fees and all other income.

From the year of assessment 2017

From the year of assessment 2017, tax rates for non-resident individuals will be raised to 22%, to maintain parity between the tax rates of non-residents and the top marginal tax rate of residents. For more information on the different types of income and effective tax rate applied, check the IRAS website page on Personal Income Tax.

Goods and Services Tax

The IRAS applies a Goods and Services Tax (GST) on the supply of goods and services and the import of goods in Singapore. This form of Value Added Tax – VAT – is applied at a standard rate of 7% to the price of goods and services sold in Singapore.

The GST is paid by the final consumer and companies are merely acting as tax collectors for the IRAS. However, depending on the amount of sales a company registers in Singapore, it will have to follow a different registration process:

- compulsory registration for companies with a turnover above 1 Million SGD,

- voluntary registration for companies with a turnover below 1 Million SGD or selling goods or financial services outside of Singapore,

- companies primarily involved in business outisde from Singapore can also be exempted from registration.

Further information on taxes in Singapore

For more information on all the details of Corporate Tax, Personal Income Tax, Goods and Services Tax as well as all the others taxes of Singapore, check the website of Inland Revenue Authority of Singapore.