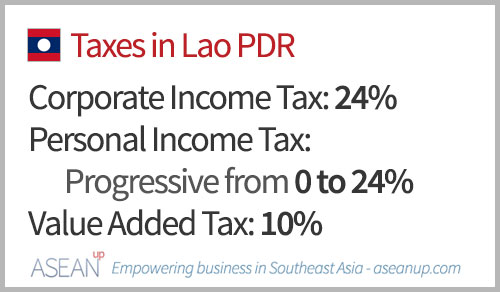

Taxes in Laos are among the lowest in the region: a low corporate income tax, a low progressive income tax and a low VAT make the country attractive for business. The Lao taxation system is quite simple and straightforward to encourage investment in the country and help develop its burgeoning economy.

Main taxes in Laos

The main taxes levied by the Lao authorities are the Corporate Income Tax, the Personal Income Tax and the Value Added Tax.

Corporate Income Tax

All companies registered in Laos and foreign companies operating in Laos are taxed at a standard flat Corporate Tax Rate of 24%, if they are registered under the Value Added Tax (VAT) system and regardless of any residency status which is not in use for tax purposes.

Small and medium companies with an annual revenue inferior to LAK 12 million are not registered in the VAT system and pay instead a progressive lump-sum tax, between 3% and 7%, depending on the nature of business and amount of revenues.

Specific corporate tax

Companies registered in the Lao Stock Exchange benefit from a 5% reduction of income tax rate for four years from the date of registration in the Stock Exchange.

Businesses involved in the tobacco industry, be they producer, importer or supplier of tobacco product are taxed at a 26% rate, with 2% of their taxes devoted to the Cigarette Control Fund.

Personal Income Tax

Personal income in Laos is taxed at a progressive rate from 0% to 24%. It is applied to all income earned in Lao PDR from salary, benefits in kind and other remunerations, both for Lao people and expatriate receiving revenues from Lao PDR or abraod regardless of the length of their employment and stay in Laos.

The Lao personal income tax rates is progressive from 0% to 24% of yearly income as follows:

- LAK 0 – 1,000,000: 0%

- LAK 1,000,001 – 3,000,000: 5%

- LAK 3,000,001 – 6,000,000: 10%

- LAK 6,000,001 – 12,000,000: 12%

- LAK 12,000,001 – 24,000,000: 15%

- LAK 24,000,001 – 40,000,000: 20%

- Above LAK 40,000,001: 24%

Expatriates with a work contract starting before 1 March 2011 may benefit from a flat personal income tax rate of 10% unless they are employed in general investment activities. Visit this page for more information on the expatriates personal income tax rates.

Value Added Tax

The Value Added Tax – VAT – is an indirect tax applicable on products sold in Laos at a standard rate of 10%, unless they receive a special exemption from the Lao government.

Excise Tax

An excise tax is applicable on certain types of goods, including fuel, alcohol, carbonated and invigorating drinks, tobacco products and cosmetics. Refer to the Lao Tax Department website for more details on the products and services submitted to excise tax and relevant tax law articles.

Import Duties

Imports of means of production (equipment, spare parts…) for foreign investors’ projects are taxed at a flat rate of 1% of the imported value. Raw materials and intermediate components imported to be processed in Laos and re-exported are exempt from import duties, provided they receive approval from relevant ministries.

Further information on taxes in Laos

For further information on Corporate Income Tax, Personal Income Tax, Value-Added Tax, as well as other direct and indirect taxes the Lao Tax Department website sums up most of the information, though it is not always clear and complete. KPMG has also prepared a very useful Laos Tax Profile, last updated in June 2015.