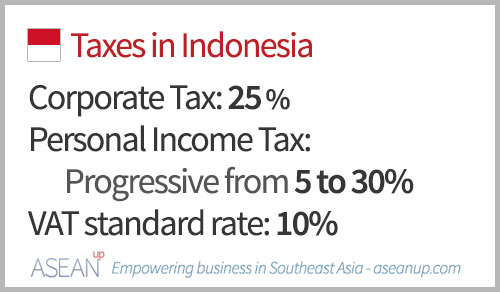

Taxes in Indonesia are comparable to other ASEAN countries and attractive to the rest of the world. With low corporate income tax and VAT, a low but progressive personal income, Indonesian taxes are business-friendly. Some tax incentives also exist to push the growth of certain key industries for the nation.

Main taxes in Indonesia

Though local taxes are also applied, the main central government taxes are the Corporate Tax, the Personal Income Tax and the Value Added Tax.

Corporate Tax

Companies in Indonesia are generally taxed with a standard flat Corporate Tax Rate of 25%. Incomes are considered taxable if they can be assessed, reduced of tax deductible expenses. Such deductible expenses can notably include taxes paid to other countries.

Also in Business

For resident companies in Indonesia, companies incorporated or with domicile in Indonesia, the 25% rate is applied on all income derived from Indonesia or abroad.

Foreign companies will be taxed if they are conducting business and present in Indonesia, or have a branch in Indonesia. They will only be taxed on the income derived from Indonesia.

Reduced corporate tax

Public companies listed with a minimum requirement of 40% and complying with certain other conditions are entitled to a reduction of 5% corporate income tax, for an effective rate of 20%.

For small companies, that is to say with an annual turnover inferior to 50 Billion Indonesian Rupiah, a discount of 50% on the tax rate is applicable for taxable income on a turnover up to 4.8 Billion Rupiah.

Corporate tax reductions for key sectors

Companies in certain industries, especially in the transport and logistics sector and oil and gas drilling industry benefit from a reduction in corporate tax. This reduction is applied through a lower consideration of profits deemed to be taxable as follows:

| Deemed profits in gross revenue | Effective income tax rate | |

| Domestic shipping operations | 4% | 1.20% |

| Domestic airline operations | 6% | 1.80% |

| Foreign airline and shipping operations | 6% | 2.64% |

| Foreign oil and gas drilling operations | 15% | 3.75% |

| Certain Ministry of Trade representative offices | 1% of export value | 0.25% |

Certain companies engaged in upstream oil and gas and geothermal activities, as well as metal, mineral and coal mining can benefit from Production-Sharing Contracts or Contracts of Works which define tax rates and assessable income on an ad hoc basis. New contracts for mining are however not been issued since the 2009 Mining Law.

Personal Income Tax

A progressive rate is applicable to most income earned by tax residents with a highest rate of 30%.

Residency is defined for any individual that resides in Indonesia, and/or is present in Indonesia for more than 183 days in a calendar year,and/or is intending to reside in Indonesia.

The personal income tax rates is progressive between 5% – 30% as defined hereafter:

- Rp 1 – 50,000,000: 5%

- Rp 50,000,001 – 250,000,000: 15%

- Rp 250,000,001 – 500,000,000: 25%

- Above Rp 500,000,001: 30%

Some concessions and tax reliefs are also available for residents depending on their status (taxpayer, spouse, dependents…) and specific financial situation. Various conditions also apply for payment, registration and filing, benefits-in-kinds, social security payments, deemed salaries: see hereafter for more information.

Withholding taxes

Taxes in Indonesia are primarily collected through a system of tax withholding. Taxpayers are required to withhold amounts payable on taxable income.

Value Added Tax

The standard Value Added Tax – VAT – rate that is generally applied in Indonesia is 10%.

However, the VAT rate can increase to 15% or decrease to 5% according to specific regulations. VAT on the export taxable tangible and intangible goods as well as export of services is fixed at 0%. Several goods and services are also defined as non-taxable.

Non-taxable goods

- Mining or drilling products extracted from their sources, such as crude oil and natural gas, geothermal energy, sand and gravel, coal and metallic ores

- Basic commodities, such as rice, salt, corn, sago and soy beans

- Food and drinks served in hotels and restaurants, consumed in their vicinity, taken away or delivered by caterers

- Money, gold bars and securities

Non-taxable services

- Medical health services

- Social services, such as orphanages or funeral services

- Mail services using stamps

- Financial services

- Insurance services

- Religious services

- Educational services

- Art and entertainment services

- Broadcasting services not used for advertising

- Public transportation and domestic air transport integrated in international air transport

- Manpower services

- Hotel services

- Public services provided by the government

- Parking area services

- Public telephone services using coins

- Remittance services by money orders

- Food or catering services

For businesses, VAT is generally applicable on the transfers of goods and provisions of taxable services in the country’s customs areas. Certain conditions and thresholds apply depending on the types of transactions.

Further information on taxes of Indonesia

For more information on all the details of such tax withholding, together with all the terms definitions, conditions for taxable incomes and their scope of applicability, reliefs, allowances, and international tax agreements, PwC has created a very complete Indonesian Pocket Tax Book in 2016.

![Guide to taxes in the Philippines [brackets-incentives] Taxes in the Philippines](https://aseanup.com/wp-content/uploads/2016/06/Philippines-taxes-150x68.jpg)

![Guide to taxes in Cambodia [brackets-incentives] Taxes in Cambodia](https://aseanup.com/wp-content/uploads/2016/03/Cambodia-taxes-150x68.jpg)

![Guide to taxes in Brunei [brackets-incentives] Taxes in Brunei Darussalam](https://aseanup.com/wp-content/uploads/2015/11/Brunei-taxes-150x68.jpg)

![Guide to taxes in Myanmar [brackets-incentives] Myanmar-taxes](https://aseanup.com/wp-content/uploads/2016/09/Myanmar-taxes-150x68.jpg)