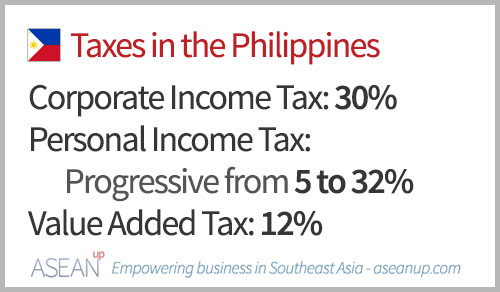

Though slightly above regional peers, taxes in the Philippines are rather low globally: low corporate income tax, low progressive income tax and and low VAT. Though the taxation system is rather simple, particular rates, formalities and methods of calculations have to be implemented to properly compute and declare taxes.

Main taxes in the Philippines

The main taxes levied by the Bureau of Internal Revenue of the Philippines are the Corporate Income Tax, the Personal Income Tax and the Value Added Tax.

Corporate Tax

Companies in the Philippines are generally taxed with a standard flat Corporate Tax Rate of 30%. This rate is generally applied on net incomes from all taxable sources.

A Minimum Corporate Income Tax (MCIT) is applied on gross income, starting from the fourth taxable year after the year of the beginning of business operations. The MCIT is imposed when the standard 30% Corporate Income Tax is inferior to 2% of MCIT of the company’s gross income.

This system of corporate taxation, 30% CIT or 2% MCIT, is generally applied to all domestic companies doing business in the Philippines, whichever is higher.

However, foreign corporations carrying trade or business in the Philippines through a branch office are considered non-resident companies and only are taxed on revenues sourced from the Philippines. Furthermore, they are taxed an additional 15% on remittances to local branches from the foreign head office.

Reduced corporate tax

The Philippine government provides help to proprietary educational institutions and non-profit hospitals with a special Corporate Income Tax of 10% of net income in the condition that their gross income from unrelated trade, business, and other activities is not higher than 50% of the total gross income.

Non-stock and non-profit educational institutions (with all assets and revenues set for educational purposes), and non-profit organizations are exempt from Corporate Income Tax.

Withholding tax

Certain types of income are subject to a withholding tax that is applied at the origin of these revenues: interests, rents, royalties, salaries, dividends, premiums (except reinsurance premiums), annuities, emoluments or other fixed or determinable annual, periodic or casual gains and capital gains.

Personal Income Tax

Personal income in the Philippines is a taxed at a progressive rate from 5% to 32%.

Resident citizens are taxed on all Philippines-sourced and foreign-sourced revenues while non-residents are only taxed only on income derived from sources within the Philippines. A person is considered a resident if he/she has been present in the Philippines for 180 days or more in a calendar year.

The personal income tax rates is progressive from 5% to 32% as defined hereafter:

- Php 0 – 10,000: 5%

- Php 10,001 – 30,000: 10%

- Php 30,001 – 70,000: 15%

- Php 70,001 – 140,000: 20%

- Php140,001 – 250,000: 25%

- Php 250,001 – 500,000: 30%

- Php 500,001 and above: 32%

These rates are applied to revenues from business and/or professional practice income (deduced of operational expenses) and compensation from employment. Other types of income are taxed with a specific rates depending on the types of revenues.

Deductions and allowances

Employees in managerial and highly technical positions in certain multinational companies and offshore business are taxed at 15% on their gross income.

Passive income such interests and dividends are taxed at 7.5%.

Value Added Tax

The Value Added Tax – VAT – is an indirect tax applicable on the sales of goods and services in the Philippines at a standard rate of 12%.

The declaration and payment of VAT in the Philippines is subject to various time schedules according to the type of products and businesses. For more information on the declaration and schedules to follow, check the information related to VAR on the Bureau of Internal Revenue website.

Further information on taxes of the Philippines

For further information on Corporate Income Tax, Withholding Taxes details, Personal Income Tax, its allowances and specific tax rates applied on particular income sources, check the official information available on the website of the Bureau of Internal Revenue.