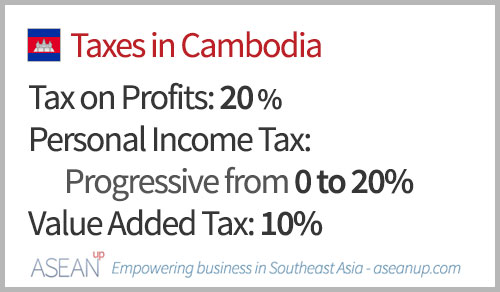

Cambodia is a business-friendly country, with a progressive but low income tax, a low corporate income tax and low equivalent to VAT which make it attractive for work and business. Other taxes are also in the lower range, further enabling professionals and companies to consider Cambodia for their operations.

Main taxes in Cambodia

The main taxes levied by the General Department of Taxation of Cambodia are the Tax on Profits, the Personal Income Tax and the Value Added Tax.

Tax on Profits

The Tax on Profits, also known as the Corporate Tax, is defined at a standard rate of 20% for companies in Cambodia. However, companies involved certain industries are taxed with another rate:

- companies in the oil and gas industry, and certain mineral exploitation activities are taxed at 30%

- companies involved in the insurance industry are taxed at 5% on their gross premium income (but not other sources of income).

Company Residency

Companies headquartered in Cambodia are considered resident, and are taxed accordingly with Cambodian Tax on Profits abroad. Non-resident companies are only taxed on their profits originating from Cambodia.

Personal Income Tax

The Cambodian authorities have set a progressive rate for personal income tax. These rates are applicable to the earnings of all tax residents: individuals based in Cambodia or residing in Cambodia for at least 182 days in a calendar year. The highest personal income tax applicable is 20%.

Personal Income tax rates applicable are as follows:

- KHR 0 – 800,000: 0%

- KHR 800,001 – 1,250,000: 5%

- KHR 1,250,001 – 8,500,000: 10%

- KHR 8,500,001 – 12,500,000: 15%

- Above KHR 12,500,000: 20%

Earnings in other currencies need to be translated in Cambodian Riels to calculate the applicable taxes. Certain types of revenues, such as redundancy payments, reimbursements of expenses, some travel allowances, etc., can be exempted from personal income tax.

For non-residents, a flat rate of 20% is applicable on revenues.

Withholding Taxes

Several non-salary sources of income are subject to withholding taxes. Rentals, services, royalties, intangibles, interests are, among others, subject to this withholding taxes, with different rates according to types of earnings and residency of taxpayers. Check the General Department of Taxation website for more information on the rates applicable to these different sources of income.

Value Added Tax

The Value Added Tax – VAT – is applicable on the sale of all goods and services in Cambodia and the duty paid value on all imported goods. It is applied at a standard rate of 10%. However, exports from Cambodia and services performed outside Cambodia benefit from a VAT rate of 0%.

Taxes on specific goods and services

A special tax rate is applied to the price of certain goods and services imported to, or produced in Cambodia. These specific rates for specific products and services are as follows:

- gazed soft drinks, alcoholic product, beer : 20%

- cigarettes: 15%

- entertainment services, air transport of passengers: 10%

- telephone services: 3%

Further information on taxes of Cambodia

For more information on all the details of Corporate Tax, Personal Income Tax, Value-Added Tax as well as all the others taxes of Cambodia, check the website of the General Department of Taxation.