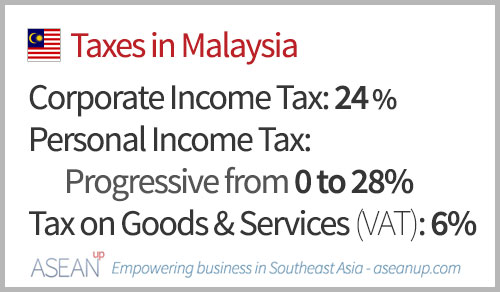

Compared to many countries, Malaysia is rather tax-friendly, with a progressive but low income tax, a low corporate income tax and low equivalent to VAT which make it attractive for work and business. Several incentives are also in place to help further companies in certain key industries.

Main taxes in Malaysia

The main taxes levied by the Inland Revenue Board of Malaysia are the Corporate Income Tax, the Personal Income Tax and the Tax on Goods and Services (a form of Value-Added Tax).

Taxable income

Though various specific regime may apply, in general companies and individuals are taxed on all earnings, business gains or profits for companies and employment revenues for individuals together with dividends, interests, royalties and other income derived from Malaysia.

Corporate Income Tax

Companies are taxed on their earnings with the exception of resident companies in the banking, insurance, air transport and shipping sectors, which are assessed on a world income scope.

The standard Corporate Tax Rate in Malaysia is 24% from 2016, reduced from 25% in 2015.

Reduced corporate tax for resident companies

A company is considered to have the “resident company” status if its management and control are exercised in Malaysia, that is to say the place where directors’ meeting are held concerning the company’s management and control is located in Malaysia.

For resident SMEs with a paid-up capital below RM 2.5 Million, a lower rate of corporate tax is applied: 19% on the first RM 500,000 of revenues for the year 2016 (down from 20% in 2015).

Non-resident companies are taxed at 24% from 2016 (25% for 2015) but they are exempted of taxes on dividends, taxed at 15% on interests, and 10% on royalties, rental of movable properties, technical or management service fees and other income.

Tax exemptions and incentives for key sectors

Provided they follow certain requirements, Malaysian companies can be granted tax exemptions, deductions, allowances and other tax incentives if they are involved in the following areas:

- Manufacturing / Services / Trading

- Biotechnology

- Education

- Financial Services

- Green Business

- Healthcare and Wellness

- Information and communication technology

- Refinery and Petrochemical Integrated Development

- Regional Operations

- Research and Development

- Logistics

- Special Economic Corridors

- Tourism, Hotels and Exhibitions

Personal Income Tax

Malaysia has a progressive scheme for personal income tax. It is applicable to all tax residents: any individual present in Malaysia for at least 182 days in a calendar year. The highest personal income tax applicable for 2016 is 28%.

From 2016, personal Income tax rates applicable to taxable income are as follows:

- RM 0 – 5,000: 0%

- RM 5,001 – 20,000: 1%

- RM 20,001 – 35,000: 5%

- RM 35,001 – 50,000: 10%

- RM 50,001 – 70,000:16%

- RM 70,001 – 100,000: 21%

- RM 100,001 – 250,000: 24%

- RM 250,001 – 400,000: 24.5%

- RM 400,001 – 600,000: 25%

- RM 600,001 – 1,000,000: 26%

- Above RM 1,000,000: 28%

Other rates apply for particular revenues of non-resident individuals, such as public entertainers’ revenues, interests, royalties and other special incomes. Some tax reliefs are also available for residents depending on their status (disability, marital, children…) and specific financial situation.

Tax on Goods and Services (VAT)

Since 1 April 2015, Malaysia imposes a Tax on Goods and Services at a standard rate of 6%. This form of Value Added Tax – VAT – replaces the former sales-and-services tax. It is payable by all intermediaries in the supply chain of most goods and services, but the tax is ultimately paid by the final consumer.

The Tax on Goods and Services does however have a zero-rate on certain goods and services. As of end 2015, these primarily include:

- Treated water to domestic consumers

- Food items such as live poultry, eggs and selected vegetables

- Medicines in the National Essential Medicines List (“NEML”)

- Export of goods

- International services

Further information on taxes of Malaysia

PwC has created a very complete and up-to-date Malaysian Tax and Business Booklet that details all the taxes levied in Malaysia for 2015 and 2016 together with the related definitions, taxable persons and incomes criteria, administrative categories and conditions required for application of taxes or allowances.

![Guide to taxes in Cambodia [brackets-incentives] Taxes in Cambodia](https://aseanup.com/wp-content/uploads/2016/03/Cambodia-taxes-150x68.jpg)

![Guide to taxes in Myanmar [brackets-incentives] Myanmar-taxes](https://aseanup.com/wp-content/uploads/2016/09/Myanmar-taxes-150x68.jpg)

![Guide to taxes in the Philippines [brackets-incentives] Taxes in the Philippines](https://aseanup.com/wp-content/uploads/2016/06/Philippines-taxes-150x68.jpg)

![Guide to taxes in Brunei [brackets-incentives] Taxes in Brunei Darussalam](https://aseanup.com/wp-content/uploads/2015/11/Brunei-taxes-150x68.jpg)