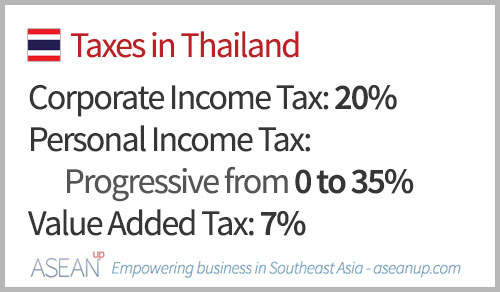

Thailand is a country with rather low taxes: a low corporate income tax, a progressive income tax and a low VAT that make the country attractive for business. Some other taxes and specific regulations are also applied to particular key sectors such as transport, banking and finance or real estate.

Main taxes in Thailand

The main taxes levied by the Revenue Department of Thailand are the Corporate Income Tax, the Personal Income Tax and the Value Added Tax.

Corporate Income Tax

Companies doing business in Thailand are usually taxed at a standard flat Corporate Income Tax Rate of 20%. This rate is applied on net taxable profits: business / trading income, passive income and capital gains or losses, deducted of expenses required to generate these revenues.

Limited companies and partnerships incorporated in Thailand and registered with the Thai Ministry of Commerce are considered to be resident companies. They are submitted to Corporate Income Tax on income generated worldwide, while non-resident companies are only taxable on income originating from Thailand.

Reduced corporate tax

Small companies, companies with a paid-up capital inferior to 5 million bahts, can benefit from a reduced income tax of 15% if they have net profits below 3 million bahts.

Furthermore, a series of special corporate income taxes are granted for companies engaged in specific activities:

- banks obtaining revenues from international banking facilities are taxed at 10% of net profits

- foreign companies involved in international transport are taxed at 3% of gross receipts

- foreign companies not carrying business in Thailand and receiving dividends from Thailand are taxed at 10% of gross receipts

- foreign companies not carrying business in Thailand and receiving dividends from Thailand are taxed at 15% of gross receipts

- foreign companies disposing profits out of Thailand are taxed at 10% of amounts disposed

Withholding tax

Certain types of income are subject to a varying withholding tax that is applied at the source of these revenues: dividends, interests, royalties, advertising fees, service and professional fees and prizes.

Personal Income Tax

Both residents and non-residents in Thailand are subject to Personal Income Tax on their income earned in Thailand. The tax rate is progressive from 0 to 35% depending on the amount of revenues. Taxable income is defined in cash and kind, therefore including the value of housing, transportation or other non-cash benefits.

Residents are however also taxed on their foreign income brought in the country. A person is defined as a resident in Thailand if he/she has been present in Thailand for 180 days or more in a calendar year.

The personal income tax rates is progressive between 0% and 35% as defined hereafter:

- THB 0 – 150,000: Exempt

- THB 150,001 – 300,000: 5%

- THB 300,001 – 500,000: 10%

- THB 500,001 – 750,000: 15%

- THB 750,001 – 1,000,000: 20%

- THB 1,000,001 – 2,000,000: 25%

- THB 2,000,001 – 4,000,000: 30%

- Above THB 4,000,001: 35%

Deductions and allowances

Certain deductions are granted for various sources of income, notably including a 40% deduction on income from employment, capped at 60,000 Bahts. Generally these deductions and allowances are subtracted from the assessable income before the tax rate is applied, according to the following method:

Taxable Income = Assessable Income – deductions – allowances

Value Added Tax

The Value Added Tax – VAT – is applicable on the supply of all goods, provision of all services and import of goods in Thailand at a standard rate of 7%.

A notable VAT exemption is granted to all companies with an annual turnover not exceeding 1.8 million bahts.

Certain other activities are exempted: on certain agricultural products and chemicals, newspapers, magazines and textbooks, certain transportation, healthcare or education services, professional services that fall under specific laws, cultural services such as amateur sports, libraries, museums and zoos…

Specific Business Tax

Certain businesses are excluded from VAT but will instead be subject to a Specific Business Tax. They will usually be imposed between 0.1% and 3% in addition to local tax rates of 10%. Such businesses notably include:

- Banking and financial services

- Life insurance

- Pawn broking

- Real estate and other businesses of immovable property

- Other businesses prescribed by a royal decree

Further information on taxes of Thailand

For more information and complete details on Corporate Income Tax, its exemptions and withholding tax, Personal Income Tax, its deductions and allowances and specific tax rates applied on interests and dividends, Value-Added Tax, Specific Business Tax and other taxes in Thailand, check the website of the Thai Revenue Department.

Additionally, Deloitte has prepared a very convenient summary of Thai taxes for 2016 and PwC a detailed booklet of taxes in Thailand (2015).

![Guide to taxes in Myanmar [brackets-incentives] Myanmar-taxes](https://aseanup.com/wp-content/uploads/2016/09/Myanmar-taxes-150x68.jpg)

![Guide to taxes in Cambodia [brackets-incentives] Taxes in Cambodia](https://aseanup.com/wp-content/uploads/2016/03/Cambodia-taxes-150x68.jpg)

![Guide to taxes in the Philippines [brackets-incentives] Taxes in the Philippines](https://aseanup.com/wp-content/uploads/2016/06/Philippines-taxes-150x68.jpg)

![Guide to taxes in Vietnam [brackets-incentives] Taxes in Vietnam](https://aseanup.com/wp-content/uploads/2016/05/Vietnam-taxes-150x68.jpg)