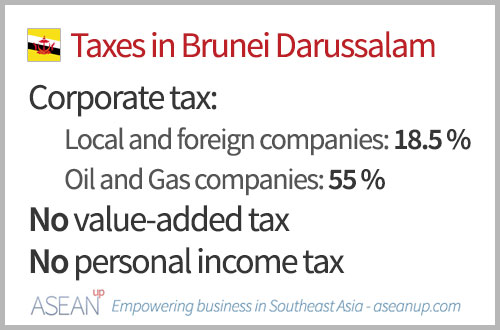

The tax regime of Brunei is generally considered to be very accommodating compared to many other countries: corporate taxes rates are rather low, and no valued added or personal income tax are levied. Some special regimes are however applied in particular cases and industries, such as the oil and gas sector.

Taxable income

The following categories of income are among the ones considered to be subject to taxes in Brunei:

- Gains or profits from any trade, business or vocation;

- Gains or profits from any employment;

- the net value of land and improvements;

- dividends, interest, or discounts;

- any pension, charge or annuity;

- rents, royalties, premiums and any other profits arising from property.

Corporate tax for local and foreign companies in Brunei Darussalam

For 2015 and subsequent years, the official Corporate Tax on any incomes defined previously accrued in, derived from, or received in Brunei by any company, registered locally or elsewhere is taxable at a flat rate of 18.5%.

The notable exception to this tax rate is that companies engaged in the exploration and production of oil and gas (a major sector in the Bruneian economy) fall under a specific regime, and their profits will be taxed at 55%.

Deductions of corporate tax and other incentives

A series of tax deductions for small and medium companies, incentives for certain industries (especially a 1% flat tax rate to encourage export), capital allowances and investments can be found on the website of the Bruneian Ministry of Finance together with links towards the different administrative agencies concerned for registration and payments of taxes

Personal Income Tax

There is no personal income tax in Brunei both for residents and non-residents.

Note that remunerations paid to non-residents company director are subject to a 20% withholding tax. Residence is retained for any individual who has been physically present or exercising employment (other than director of a company) in Brunei for 183 days or more in the year preceding assessment.

Value Added Tax – VAT

Brunei does not have a Value Added Tax or any tax levied upon sales.

Further information on taxes of Brunei

Aside from the details of deductions and incentives, and the various threshold for different companies sizes presented in the website of the Bruneian Ministry of Finance, Deloitte has put together a very handy tax highlights leaflet summarizing all the main taxes and related definitions, administrative categories and responsible agencies in Brunei.

![Guide to taxes in the Philippines [brackets-incentives] Taxes in the Philippines](https://aseanup.com/wp-content/uploads/2016/06/Philippines-taxes-150x68.jpg)

![Guide to taxes in Myanmar [brackets-incentives] Myanmar-taxes](https://aseanup.com/wp-content/uploads/2016/09/Myanmar-taxes-150x68.jpg)

![Guide to taxes in Cambodia [brackets-incentives] Taxes in Cambodia](https://aseanup.com/wp-content/uploads/2016/03/Cambodia-taxes-150x68.jpg)

![Guide to taxes in Malaysia [brackets-incentives] Taxes in Malaysia](https://aseanup.com/wp-content/uploads/2015/12/Malaysia-taxes-150x68.jpg)